Mastering the Role of a Conversion Trader: A Comprehensive Guide

Introduction

In the fast-paced world of trading, the role of a conversion trader stands out due to its unique focus on maximizing conversions and optimizing trading outcomes. A conversion trader leverages various strategies and tools to enhance the efficiency of trades and ensure profitable results. This comprehensive guide will delve into the key aspects of being a conversion trader, including essential strategies, tools, platforms, and tips for success. Whether you’re new to trading or looking to specialize as a conversion trader, this guide will provide valuable insights to enhance your trading journey.

What is a Conversion Trader?

A conversion trader is a specialist in the trading world who focuses on converting assets to maximize profitability. This role involves understanding market trends, leveraging conversion strategies, and using advanced tools to achieve optimal trading outcomes. By mastering the techniques of a conversion trader, individuals can enhance their trading efficiency and profitability.

Key Concepts in Conversion Trading

Understanding the key concepts in conversion trading is crucial for success. This section covers fundamental concepts such as arbitrage, market inefficiencies, and price spreads. By grasping these concepts, conversion traders can make informed decisions and develop effective trading strategies.

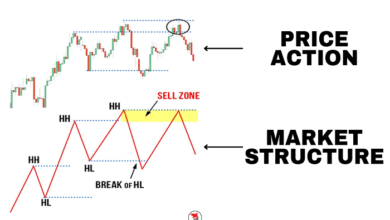

Essential Strategies for Conversion Traders

Successful conversion traders employ a variety of strategies to maximize their returns. This section explores essential strategies, including hedging, pairs trading, and statistical arbitrage. Implementing these strategies can help conversion traders optimize their trades and enhance profitability.

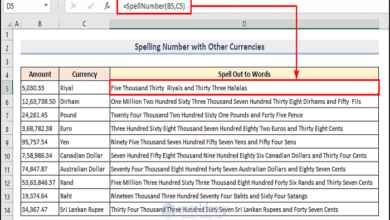

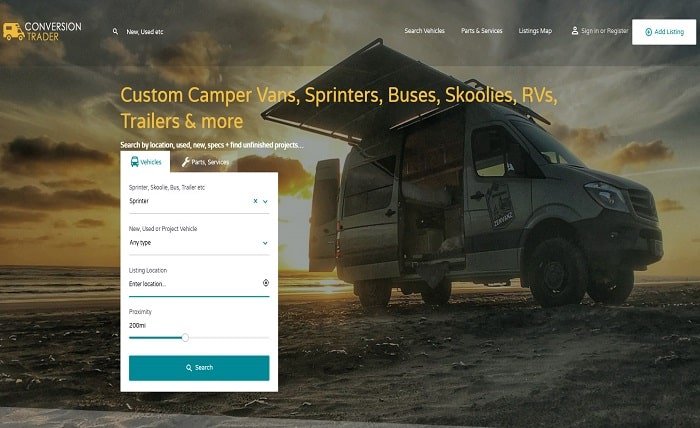

Tools and Platforms for Conversion Trading

Effective conversion trading requires the use of specialized tools and platforms. This section discusses key tools such as trading algorithms, charting software, and data analysis platforms. Utilizing these tools can provide conversion traders with a competitive edge and improve their trading performance.

Risk Management in Conversion Trading

Risk management is a critical aspect of conversion trading. This section explores techniques for managing risk, including setting stop-loss orders, diversifying portfolios, and using risk-adjusted performance metrics. Implementing robust risk management strategies can protect a conversion trader’s capital and ensure long-term success.

The Role of Technology in Conversion Trading

Technology plays a significant role in modern conversion trading. This section examines the impact of technological advancements such as high-frequency trading, machine learning, and artificial intelligence on the role of a conversion trader. Leveraging technology can enhance a conversion trader’s ability to analyze markets and execute trades efficiently.

Developing a Conversion Trading Plan

A well-structured trading plan is essential for conversion traders. This section provides a step-by-step guide to developing a conversion trading plan, including setting goals, defining strategies, and establishing risk management rules. A comprehensive trading plan serves as a roadmap for achieving trading objectives.

Continuous Learning and Skill Development

Continuous learning is key to staying competitive as a conversion trader. This section highlights the importance of ongoing education and skill development. Resources such as trading courses, webinars, and trading communities can help conversion traders stay updated with the latest trends and strategies.

The Psychology of a Successful Conversion Trader

Psychology plays a crucial role in the success of a conversion trader. This section discusses the impact of emotions such as fear, greed, and overconfidence on trading decisions. Understanding and managing these emotions can help conversion traders maintain discipline and a rational approach to trading.

Future Trends in Conversion Trading

The future of conversion trading looks promising with ongoing advancements in technology and market dynamics. This section explores potential future trends, such as the integration of blockchain technology, the rise of decentralized finance (DeFi), and the increasing use of automated trading systems. Staying informed about these trends can help conversion traders adapt and thrive in the evolving trading landscape.

Conclusion

The role of a conversion trader is dynamic and rewarding, offering numerous opportunities for financial growth and personal development. By understanding key concepts, implementing effective strategies, leveraging advanced tools, and maintaining a disciplined approach, conversion traders can optimize their trades and achieve their financial goals. Whether you’re a beginner or an experienced trader, this comprehensive guide provides all the information you need to succeed as a conversion trader. Remember to continuously educate yourself, manage risks effectively, and stay updated with the latest trends to enhance your trading journey.

FAQs

1. What is a conversion trader? A conversion trader specializes in converting assets to maximize profitability by understanding market trends, leveraging conversion strategies, and using advanced tools to achieve optimal trading outcomes.

2. What are key concepts in conversion trading? Key concepts in conversion trading include arbitrage, market inefficiencies, and price spreads. These concepts help traders make informed decisions and develop effective strategies.

3. What strategies do conversion traders use? Conversion traders use strategies such as hedging, pairs trading, and statistical arbitrage to optimize trades and enhance profitability.

4. What tools are essential for conversion trading? Essential tools for conversion trading include trading algorithms, charting software, and data analysis platforms, which provide a competitive edge and improve trading performance.

5. How important is psychology in conversion trading? Psychology is crucial in conversion trading as emotions like fear, greed, and overconfidence can impact trading decisions. Managing these emotions helps maintain discipline and a rational approach to trading.