Introduction

Alternative investments are financial assets that differ from traditional investments like stocks, bonds, and cash. They include a wide range of assets such as real estate, private equity, hedge funds, commodities, and more. This guide will delve into the various aspects of alternative investments, providing insights into their benefits, risks, and strategies for incorporating them into a diversified portfolio.

Alternative Investments

Alternative investments encompass a broad category of assets that are not typically found in standard investment portfolios. These investments offer unique opportunities for diversification and potential higher returns but also come with their own set of challenges and risks. This section will provide an overview of what alternative investments are and why they are an important consideration for investors.

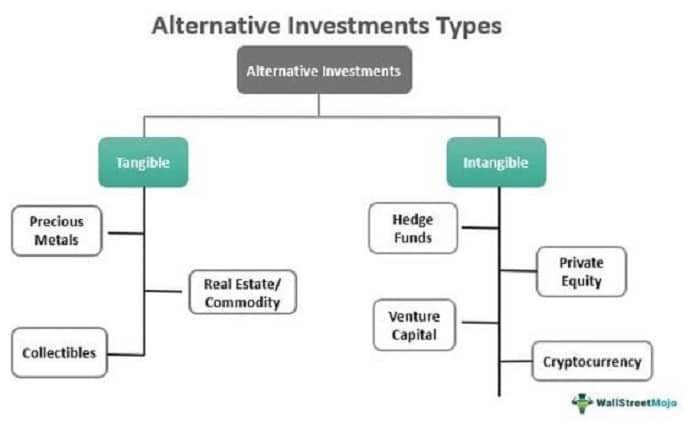

Types of Alternative Investments

There are several types of alternative investments, each with distinct characteristics and benefits. Understanding the different types of alternative investments can help investors choose the right assets for their portfolios. This section will explore the most common types of alternative investments:

- Real Estate: Investing in residential, commercial, or industrial properties for rental income and appreciation.

- Private Equity: Investing in private companies or startups with high growth potential.

- Hedge Funds: Pooled funds that employ various strategies to achieve high returns, often involving complex risk management techniques.

- Commodities: Physical assets like gold, oil, or agricultural products that can hedge against inflation and market volatility.

- Venture Capital: Investing in early-stage companies with innovative ideas and high growth potential.

- Cryptocurrencies: Digital assets that use blockchain technology, such as Bitcoin and Ethereum.

Benefits of Alternative Investments

Alternative investments offer several benefits that can enhance a diversified portfolio. This section will discuss the key advantages of alternative investments:

- Diversification: Alternative investments can provide exposure to asset classes that are not correlated with traditional markets, reducing overall portfolio risk.

- Potential for Higher Returns: Some alternative investments, like private equity and venture capital, can offer significant returns due to their high growth potential.

- Inflation Hedge: Assets like real estate and commodities can protect against inflation by maintaining their value over time.

- Access to Unique Opportunities: Alternative investments can offer access to niche markets and exclusive investment opportunities that are not available in public markets.

Risks of Alternative Investments

While alternative investments offer significant benefits, they also come with risks. Understanding these risks is crucial for making informed investment decisions. This section will explore the primary risks associated with alternative investments:

- Illiquidity: Many alternative investments are not easily sold or traded, making it difficult to access funds quickly.

- Complexity: Alternative investments often involve complex strategies and require a high level of expertise to manage effectively.

- High Fees: Some alternative investments, like hedge funds, charge high management and performance fees.

- Limited Transparency: Alternative investments may lack the regulatory oversight and transparency of traditional investments.

Strategies for Investing in Alternative Investments

Effective investment strategies are crucial for maximizing returns while managing risk in alternative investments. This section will discuss various strategies for investing in alternative investments:

- Due Diligence: Conduct thorough research and analysis to understand the potential risks and rewards of an alternative investment.

- Diversification: Spread investments across different types of alternative assets to reduce risk.

- Long-Term Focus: Many alternative investments require a long-term commitment to realize their full potential.

- Partner with Experts: Consider working with financial advisors or fund managers who specialize in alternative investments.

The Role of Alternative Investments in a Diversified Portfolio

Alternative investments play a vital role in building a diversified investment portfolio. This section will discuss how alternative investments can complement traditional assets, enhance portfolio performance, and align with an investor’s financial goals and risk tolerance.

Performance Evaluation of Alternative Investments

Evaluating the performance of alternative investments is crucial for understanding their contribution to a portfolio. This section will provide insights into different performance metrics and how to use them to evaluate the success of alternative investments. Key metrics include historical returns, risk-adjusted returns, and benchmark comparison.

Tax Considerations for Alternative Investments

Taxes can significantly impact the returns on alternative investments. Understanding the tax implications of different alternative investments can help investors optimize their after-tax returns. This section will explore tax considerations for alternative investments, including capital gains, income from rental properties, and tax-advantaged accounts.

Regulatory Environment for Alternative Investments

The regulatory environment for alternative investments can vary widely depending on the asset class and jurisdiction. This section will discuss the importance of understanding the regulatory landscape for alternative investments and how it affects investment decisions. Topics include regulatory oversight, reporting requirements, and investor protections.

Future Trends in Alternative Investments

The landscape of alternative investments is constantly evolving, driven by technological advancements, market trends, and regulatory changes. This section will explore potential future trends in alternative investments, including the rise of digital assets, increased focus on sustainable and impact investing, and the growing accessibility of alternative investments for retail investors.

Conclusion:

Alternative investments offer unique opportunities for diversification, potential higher returns, and access to niche markets. By understanding the different types of alternative investments, their benefits, risks, and effective investment strategies, investors can make informed decisions and enhance their portfolios. Embracing alternative investments can provide a valuable addition to a well-rounded investment strategy, helping investors achieve their financial goals.

FAQs

- What are alternative investments? Alternative investments are financial assets that differ from traditional investments like stocks, bonds, and cash. They include real estate, private equity, hedge funds, commodities, venture capital, and cryptocurrencies.

- What are the benefits of alternative investments? The benefits of alternative investments include diversification, potential for higher returns, an inflation hedge, and access to unique investment opportunities. These benefits can enhance a diversified portfolio and help achieve financial goals.

- What are the risks of alternative investments? The primary risks of alternative investments include illiquidity, complexity, high fees, and limited transparency. Understanding these risks is crucial for making informed investment decisions.

- How can I invest in alternative investments? To invest in alternative investments, conduct thorough due diligence, diversify across different types of alternative assets, focus on long-term goals, and consider partnering with financial advisors or fund managers who specialize in alternative investments.

- What role do alternative investments play in a diversified portfolio? Alternative investments play a vital role in building a diversified portfolio by providing exposure to asset classes that are not correlated with traditional markets, enhancing portfolio performance, and aligning with an investor’s financial goals and risk tolerance.