Crafting a Winning Investment Strategy: A Comprehensive Guide

Introduction

An effective investment strategy is crucial for achieving your financial goals. By carefully planning and executing your investment decisions, you can maximize your returns while minimizing risks. This comprehensive guide will explore various aspects of investment strategy, helping you craft a plan tailored to your financial needs and objectives.

The Basics of Investment Strategy

Before diving into specific investment strategies, it’s important to understand the basics. An investment strategy is a set of principles and techniques used to guide your investment decisions. This section will introduce the core components of an investment strategy, including risk tolerance, time horizon, and asset allocation.

The Importance of Diversification in Investment Strategy

Diversification is a fundamental principle of any investment strategy. By spreading your investments across different asset classes, you can reduce risk and improve potential returns. This section will explain the benefits of diversification and how to implement it effectively in your investment strategy.

Identifying Your Investment Goals

Setting clear investment goals is the first step in developing a successful investment strategy. Whether you’re saving for retirement, a down payment on a house, or your child’s education, your goals will shape your strategy. This section will help you identify and prioritize your investment goals.

Assessing Your Risk Tolerance

Risk tolerance is the degree of variability in investment returns that you are willing to withstand. Understanding your risk tolerance is essential for creating an investment strategy that aligns with your financial situation and comfort level. This section will guide you through assessing your risk tolerance.

Asset Allocation: The Foundation of Investment Strategy

Asset allocation involves dividing your investment portfolio among different asset categories, such as stocks, bonds, and cash. The right asset allocation strategy is crucial for balancing risk and return. This section will explore various asset allocation models and how to choose the best one for your investment strategy.

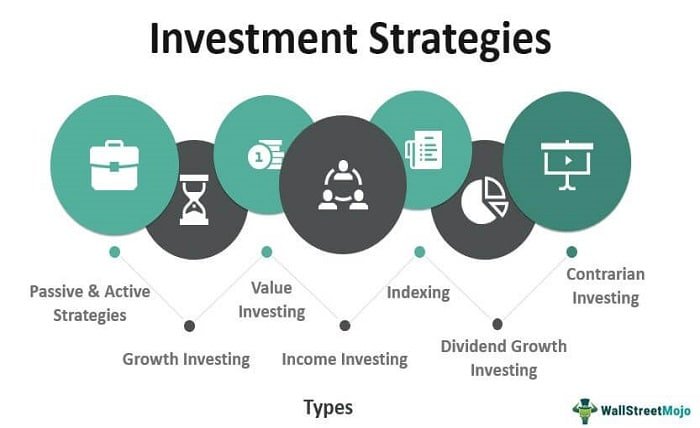

Growth vs. Value Investing

Growth and value investing are two popular investment strategies. Growth investing focuses on companies expected to grow at an above-average rate, while value investing targets undervalued stocks. This section will compare growth and value investing, helping you decide which approach fits your investment strategy.

Active vs. Passive Investing

Active and passive investing are two different approaches to managing an investment portfolio. Active investing involves selecting stocks and timing the market to outperform benchmarks, while passive investing aims to replicate market indices. This section will discuss the pros and cons of both strategies and their role in your investment strategy.

The Role of Bonds in Your Investment Strategy

Bonds are a key component of many investment strategies, offering stability and income. This section will explain the different types of bonds, their benefits, and how to incorporate them into your investment strategy to reduce risk and diversify your portfolio.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are popular investment vehicles that provide diversification and professional management. This section will explore how mutual funds and ETFs work, their advantages and disadvantages, and how to include them in your investment strategy.

Real Estate as an Investment Strategy

Real estate can be a lucrative addition to your investment strategy, providing potential for appreciation and rental income. This section will discuss different ways to invest in real estate, such as direct property ownership, REITs, and real estate crowdfunding.

Evaluating Your Investment Performance

Regularly evaluating your investment performance is crucial for ensuring your strategy remains aligned with your goals. This section will cover key performance metrics, how to assess your portfolio’s performance, and when to make adjustments to your investment strategy.

Adapting Your Investment Strategy Over Time

Your investment strategy should evolve as your financial situation and goals change. This section will provide guidance on how to adapt your strategy to life events, market conditions, and new financial goals, ensuring your investment strategy remains effective over the long term.

Conclusion

Crafting a successful investment strategy requires careful planning, ongoing assessment, and the flexibility to adapt to changing circumstances. By understanding the core principles and strategies discussed in this guide, you can develop an investment strategy that aligns with your financial goals and risk tolerance. Regularly reviewing and adjusting your strategy will help you stay on track and achieve long-term financial success.

FAQs

1. What is an investment strategy? An investment strategy is a set of principles and techniques used to guide your investment decisions. It includes considerations of risk tolerance, time horizon, and asset allocation to achieve specific financial goals.

2. Why is diversification important in an investment strategy? Diversification reduces risk by spreading investments across different asset classes, industries, and geographic regions. This helps mitigate the impact of poor performance in any single investment.

3. How do I determine my risk tolerance for an investment strategy? Assess your risk tolerance by considering your financial goals, investment time horizon, and comfort level with market fluctuations. Understanding your risk tolerance helps you choose appropriate investments.

4. What is the difference between active and passive investing? Active investing involves selecting stocks and timing the market to outperform benchmarks, while passive investing aims to replicate market indices. Each approach has its pros and cons and can be incorporated into an investment strategy.

5. How often should I evaluate my investment strategy? Regularly evaluate your investment strategy, at least annually or when significant life events or market changes occur. This ensures your strategy remains aligned with your financial goals and risk tolerance.