Asset Classes: A Comprehensive Guide to Diversified Investment

Introduction

Asset classes are fundamental building blocks of diversified investment portfolios. This comprehensive guide explores different asset classes, their characteristics, strategies for investing, historical context, and answers to common questions. Understanding asset classes can significantly enhance your financial planning and ensure you make informed decisions.

What Are Asset Classes?

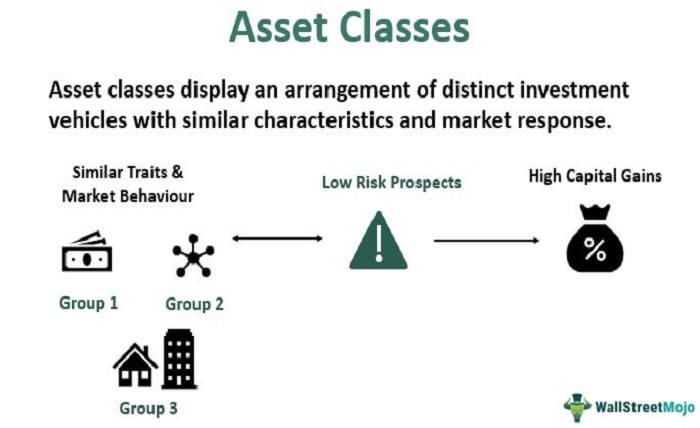

Asset classes are categories of investments with similar characteristics and behaviors in the market. This section introduces asset classes, explaining their significance and how they can benefit your financial situation. Understanding what asset classes entail is the first step towards effective financial planning.

The History of Asset Classes

The history of asset classes is rich and varied, influenced by economic developments and financial innovations. This section explores the evolution of asset classes, from traditional assets like real estate and stocks to modern instruments like cryptocurrencies. Knowing the history provides valuable context for the practice of investing in various asset classes.

Types of Asset Classes

To make informed decisions, it is crucial to understand the different types of asset classes available. This section categorizes various asset classes, including equities, fixed income, real estate, commodities, and alternative investments. A clear understanding of the types of asset classes is essential for building a diversified portfolio.

Equities as an Asset Class

Equities, or stocks, are a popular asset class, offering the potential for significant returns. This section explains how equities work, the benefits of investing in stocks, and strategies for selecting the right equities. Utilizing equities effectively can enhance your investment portfolio.

Fixed Income as an Asset Class

Fixed income investments, such as bonds, provide regular income and stability. This section explores how fixed income works, the benefits they offer, and how to invest in them. Understanding fixed income as an asset class can improve your financial stability and income generation.

Real Estate as an Asset Class

Real estate is a tangible asset class that can provide substantial returns through rental income and property appreciation. This section explains the benefits of investing in real estate, strategies for selecting properties, and tips for managing real estate investments. Real estate is a valuable asset class for long-term wealth building.

Commodities as an Asset Class

Commodities include physical goods like gold, oil, and agricultural products. This section discusses how commodities work, their benefits, and how to invest in them. Commodities can offer diversification and protection against inflation in your investment portfolio.

Alternative Investments as an Asset Class

Alternative investments encompass assets like private equity, hedge funds, and cryptocurrencies. This section explores the benefits and risks of alternative investments and strategies for incorporating them into your portfolio. Alternative investments can offer diversification and potentially high returns.

The Importance of Diversification Across Asset Classes

Diversification involves spreading your investments across different asset classes to reduce risk. This section discusses the importance of diversification and how to achieve it with various asset classes. Proper diversification ensures a balanced and resilient investment portfolio.

Common Mistakes in Investing Across Asset Classes and How to Avoid Them

Many investors make common mistakes that can hinder their success in investing across asset classes. This section identifies these mistakes and provides advice on how to avoid them. Learning from these mistakes can improve your overall investment performance.

Legal and Ethical Considerations in Investing in Asset Classes

It is important to be aware of the legal and ethical considerations when investing in asset classes. This section discusses the legal regulations and ethical implications of various investments. Understanding these considerations ensures that you engage in responsible and compliant investing.

Online Platforms and Tools for Managing Investments Across Asset Classes

With the rise of the internet, many online platforms and tools offer services related to managing investments across asset classes. This section explores the various online resources available, their features, and how to choose a reliable one. Utilizing online platforms can provide additional resources and convenience for managing your investments.

Future Trends in Asset Classes

The world of asset classes is constantly evolving, with new trends and technologies emerging. This section looks at future trends in asset classes, such as the use of artificial intelligence and sustainable investing. Staying informed about these trends can give you an edge in maximizing your investment returns.

Conclusion

Asset classes are critical aspects of financial planning, offering various avenues to grow your wealth. By understanding the strategies, tips, and common questions, you can enhance your chances of success in investing across different asset classes. Engaging responsibly and staying informed about the latest trends will ensure a rewarding experience in this crucial aspect of financial management.

FAQs

1. What are asset classes, and how do they work? Asset classes are categories of investments with similar characteristics and behaviors in the market. They work by grouping assets into categories like equities, fixed income, real estate, commodities, and alternative investments to help investors diversify their portfolios and manage risk.

2. Can intuition play a significant role in choosing asset classes? While intuition can guide decisions, choosing asset classes primarily relies on understanding financial markets, analyzing data, and employing proven strategies. Balancing intuition with informed strategies can enhance your chances of success.

3. How important is diversification across asset classes? Diversification is crucial when investing across asset classes. It involves spreading your investments across different asset categories to reduce risk and achieve a balanced portfolio. Proper diversification helps prevent significant losses and promotes long-term financial stability.

4. Are there online platforms for managing investments across asset classes, and how do they work? Yes, there are many online platforms that offer services related to managing investments across asset classes. These platforms provide tools for tracking investments, analyzing market trends, and offering educational resources. Choosing a reliable platform is important for accessing accurate information and enhancing your ability to manage your investments effectively.

5. What are the legal and ethical considerations in investing in asset classes? The legal and ethical considerations in investing in asset classes vary by region and financial context. It is important to be aware of the legal regulations governing investments in your area and to engage in responsible and compliant investing. Ethical considerations include avoiding fraudulent schemes, investing in socially responsible assets, and not engaging in illegal activities related to financial management.

Discover unfite the innovative platform that transforms fitness routines. Explore personalized workout plans, nutrition tips, and community support for a healthier lifestyle. Join today!