Currency Speculation Takes Place When:Dynamics, Risks, and Opportunities

Introduction

Currency speculation takes place when traders attempt to profit from fluctuations in the exchange rates of different currencies. This practice can significantly influence global financial markets, economies, and individual fortunes. Understanding the mechanics of currency speculation, its risks, and the opportunities it presents is crucial for anyone involved in or interested in the financial markets.

What is Currency Speculation?

Currency speculation takes place when traders buy and sell currencies with the aim of making a profit from changes in exchange rates. This involves predicting future movements in currency values and strategically trading to capitalize on these predictions.

The Role of Forex Markets

Currency speculation takes place primarily in the foreign exchange (Forex) markets, where currencies are traded 24 hours a day, five days a week. These markets are the largest and most liquid in the world, providing ample opportunities for speculative trading.

Factors Influencing Currency Values

Currency speculation takes place when various factors influence currency values, including economic indicators, political events, and market sentiment. Traders analyze these factors to forecast currency movements and make informed trading decisions.

Economic Indicators and Currency Speculation

Economic indicators such as GDP growth, unemployment rates, and inflation play a crucial role in currency speculation. Speculators monitor these indicators to gauge the health of an economy and predict potential currency movements.

Political Events and Their Impact

Currency speculation takes place when political events, such as elections, policy changes, and geopolitical tensions, affect market confidence and currency values. Traders must stay informed about global politics to anticipate market reactions.

Market Sentiment and Speculative Trading

Market sentiment, driven by trader psychology and behavior, can significantly impact currency values. Currency speculation takes place when traders collectively act on their perceptions of market conditions, creating trends and influencing exchange rates.

The Mechanics of Currency Trading

Currency speculation takes place when traders engage in buying and selling currency pairs, such as EUR/USD or GBP/JPY. Understanding how these pairs work and the mechanics of currency trading is essential for successful speculation.

Leverage and Its Role in Currency Speculation

Leverage allows traders to control large positions with relatively small amounts of capital. Currency speculation takes place when traders use leverage to amplify potential profits, but it also increases the risk of significant losses.

Risks Involved in Currency Speculation

Currency speculation takes place when traders accept various risks, including market volatility, leverage-related risks, and geopolitical uncertainties. Managing these risks is vital for long-term success in currency trading.

Strategies for Successful Currency Speculation

Currency speculation takes place when traders employ various strategies, such as technical analysis, fundamental analysis, and sentiment analysis, to predict currency movements and make profitable trades.

Technical Analysis in Currency Speculation

Technical analysis involves studying historical price charts and using indicators to forecast future currency movements. Currency speculation takes place when traders apply technical analysis to identify trading opportunities.

Fundamental Analysis and Its Importance

Fundamental analysis focuses on economic and financial data to determine the intrinsic value of a currency. Currency speculation takes place when traders use fundamental analysis to make informed decisions based on economic fundamentals.

Sentiment Analysis in Trading

Sentiment analysis involves gauging the overall mood of the market to predict currency movements. Currency speculation takes place when traders assess market sentiment and align their trades with prevailing trends.

The Role of Technology in Currency Speculation

Advanced technology, including trading platforms and algorithmic trading systems, has revolutionized currency speculation. Currency speculation takes place when traders leverage these tools to enhance their trading efficiency and accuracy.

Legal and Ethical Considerations

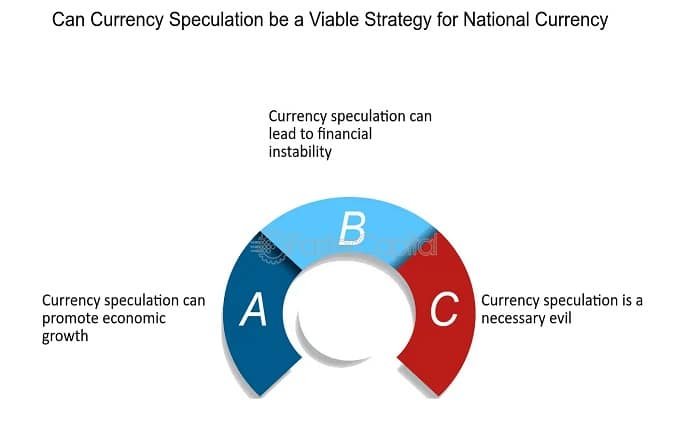

Currency speculation takes place within a regulatory framework designed to ensure fair and transparent trading practices. Adhering to legal and ethical standards is crucial for maintaining the integrity of the Forex markets.

Conclusion

Currency speculation takes place when traders seek to profit from the dynamic and often unpredictable movements in exchange rates. By understanding the factors that influence currency values, employing effective trading strategies, and managing risks, traders can navigate the complexities of the Forex markets. While currency speculation offers significant opportunities, it also requires a thorough understanding of market dynamics and a disciplined approach to trading.

FAQs

1. What is currency speculation? Currency speculation takes place when traders buy and sell currencies to profit from fluctuations in exchange rates, predicting future movements to make profitable trades.

2. How does leverage affect currency speculation? Leverage allows traders to control larger positions with less capital. Currency speculation takes place when traders use leverage to amplify profits, but it also increases the risk of significant losses.

3. What are the main risks of currency speculation? Currency speculation takes place with risks such as market volatility, leverage-related risks, and geopolitical uncertainties. Proper risk management is essential for success.

4. What strategies do traders use for currency speculation? Traders use strategies like technical analysis, fundamental analysis, and sentiment analysis. Currency speculation takes place when these strategies help predict currency movements and identify trading opportunities.

5. How important is market sentiment in currency speculation? Market sentiment plays a crucial role as it reflects the collective mood of traders. Currency speculation takes place when traders align their trades with prevailing market trends based on sentiment analysis.