Forex Trading in India: A Comprehensive Guide for Aspiring Traders

Introduction

Forex trading, or foreign exchange trading, has become increasingly popular in India over the past decade. As more individuals seek to diversify their investment portfolios, understanding the dynamics of forex trading in India is crucial. This blog post delves into everything you need to know about forex trading in India, from the basics to advanced strategies.

Forex Trading

Forex trading involves buying and selling currencies in the global marketplace. In India, forex trading has gained traction as a viable investment option. It’s essential to grasp the fundamentals of how the forex market operates, including the role of currency pairs, exchange rates, and market participants.

Regulatory Framework for Forex Trading in India

The forex trading landscape in India is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Understanding the regulatory framework is crucial for anyone looking to engage in forex trading in India. The RBI has set specific guidelines to ensure the integrity and stability of the forex market.

Legal Aspects of Forex Trading in India

Legal aspects of forex trading in India include adherence to RBI and SEBI regulations, ensuring that traders only use authorized platforms and brokers. It’s vital to be aware of these legalities to avoid penalties and ensure a smooth trading experience. Forex trading in India must be conducted through recognized and legal channels to be compliant with the law.

Choosing the Right Forex Broker in India

Selecting the right forex broker is a critical step in forex trading in India. A reliable broker can provide access to the forex market, offer trading platforms, and ensure that transactions are secure and compliant with Indian regulations. Researching and comparing brokers based on their reputation, fees, and customer service is essential.

Popular Forex Trading Platforms in India

Several forex trading platforms cater to Indian traders, each offering unique features and tools. Platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader are popular choices. These platforms provide comprehensive tools for analysis, trading, and managing forex portfolios, making forex trading in India more accessible and efficient.

Developing a Forex Trading Strategy

A well-defined trading strategy is crucial for success in forex trading in India. Strategies can range from technical analysis, which involves studying price charts and patterns, to fundamental analysis, which focuses on economic indicators and news. Creating a strategy that suits your trading style and risk tolerance is key to achieving consistent results in forex trading.

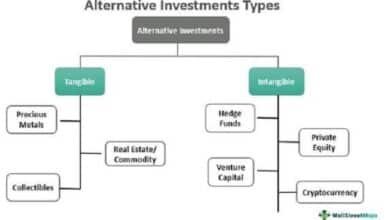

Risk Management in Forex Trading

Risk management is a fundamental aspect of forex trading in India. It involves using tools and techniques to minimize potential losses, such as stop-loss orders, position sizing, and diversification. Effective risk management can help traders protect their capital and ensure long-term success in the volatile forex market.

The Role of Economic Indicators in Forex Trading

Economic indicators play a significant role in forex trading in India. Indicators such as GDP growth, inflation rates, and employment figures can influence currency values. Understanding these indicators and how they affect the forex market can help traders make informed decisions and develop more effective trading strategies.

Forex Trading Education and Resources

Education is vital for anyone looking to succeed in forex trading in India. Numerous resources are available, including online courses, webinars, and trading forums. Continuous learning and staying updated with market trends can enhance your trading skills and improve your chances of success in forex trading.

Future Prospects of Forex Trading in India

The future of forex trading in India looks promising, with advancements in technology and increased interest from retail investors. The regulatory environment is also evolving to accommodate the growing forex market. Staying informed about these developments can help traders capitalize on new opportunities and stay ahead in the competitive world of forex trading.

Conclusion

Forex trading in India offers numerous opportunities for investors willing to learn and adapt. By understanding the regulatory framework, choosing the right broker, developing a sound trading strategy, and continuously educating oneself, traders can navigate the complexities of the forex market. With the right approach and mindset, forex trading in India can be a rewarding venture.

FAQs

1. Is forex trading legal in India?

Yes, forex trading is legal in India, provided it is conducted through recognized and regulated brokers and platforms, and adheres to RBI and SEBI regulations.

2. How can I start forex trading in India?

To start forex trading in India, you need to choose a regulated broker, open a trading account, and familiarize yourself with trading platforms and strategies.

3. What are the risks involved in forex trading in India?

Forex trading in India involves risks such as market volatility, leverage risks, and the potential for significant losses. Effective risk management strategies are essential to mitigate these risks.

4. Can I trade forex on my mobile device in India?

Yes, many forex trading platforms offer mobile apps that allow you to trade forex on the go, providing flexibility and convenience.

5. What are the best forex trading platforms in India?

Some of the best forex trading platforms in India include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, known for their comprehensive tools and user-friendly interfaces.