Introduction

Investing money online has become increasingly popular due to the convenience and accessibility it offers. The internet provides a plethora of platforms and tools that allow individuals to invest money online with ease. Whether you are looking to invest in stocks, bonds, real estate, or other assets, understanding how to invest money online can help you achieve your financial goals. This comprehensive guide will explore various aspects of online investing, including the best platforms, strategies, and tips to help you get started.

Investing money online is not just about choosing the right platform; it also involves understanding the basics of investing, knowing how to analyze opportunities, and being aware of the risks involved. By learning how to invest money online, you can take control of your financial future and potentially grow your wealth over time.

Benefits of Investing Money Online

One of the main benefits of investing money online is the convenience it offers. With just a few clicks, you can open an investment account, transfer funds, and start building your portfolio. Online platforms provide a wide range of investment options, allowing you to diversify your investments and reduce risk. Additionally, many online investment platforms offer educational resources, tools, and features that can help you make informed decisions.

Another significant benefit of investing money online is the lower cost compared to traditional investment methods. Online brokers often charge lower fees and commissions, which means more of your money goes toward your investments. Furthermore, online platforms provide real-time access to your investment portfolio, enabling you to monitor performance and make adjustments as needed.

The Basics of Online Investing

Before you invest money online, it’s essential to understand the basics of investing. Investing involves putting your money into assets with the expectation of generating a return over time. Common investment options include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Each type of investment has its own risk and return profile, and understanding these differences is crucial to making informed decisions.

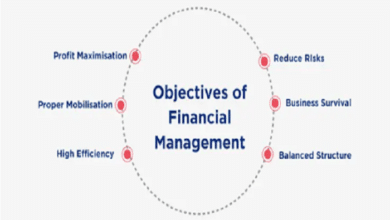

When you invest money online, you need to consider factors such as your investment goals, risk tolerance, and time horizon. Setting clear financial goals will help you determine the appropriate investment strategy and asset allocation. Additionally, understanding your risk tolerance will help you choose investments that align with your comfort level. Lastly, considering your time horizon will guide you in selecting investments that match your timeline for achieving your financial goals.

Choosing the Right Online Investment Platform

Choosing the right platform to invest money online is a critical step in your investment journey. There are numerous online investment platforms available, each with its own features, fees, and investment options. When selecting a platform, consider factors such as ease of use, customer support, fees, and the range of investment products offered.

Popular online investment platforms include Robinhood, E*TRADE, TD Ameritrade, and Fidelity. These platforms offer various tools and resources to help you invest money online effectively. Additionally, some platforms cater to specific types of investors, such as those interested in socially responsible investing or robo-advisors. Researching and comparing different platforms will help you find the one that best meets your needs.

Diversifying Your Investment Portfolio

Diversification is a key principle when you invest money online. It involves spreading your investments across different asset classes, sectors, and geographies to reduce risk. A diversified portfolio is less likely to be affected by the poor performance of a single investment, which can help protect your overall returns.

When you invest money online, you can diversify your portfolio by investing in a mix of stocks, bonds, mutual funds, ETFs, and real estate. Additionally, you can diversify within each asset class by investing in different industries, companies, and geographic regions. Online investment platforms often provide tools and resources to help you create a diversified portfolio tailored to your financial goals and risk tolerance.

Strategies for Successful Online Investing

Successful online investing requires a strategic approach. One popular strategy is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility and can lead to more consistent returns over time.

Another strategy when you invest money online is to focus on long-term growth rather than short-term gains. Long-term investing allows you to take advantage of compounding returns, where the returns on your investments generate additional returns. Additionally, it’s essential to stay informed about market trends, economic conditions, and the performance of your investments. Regularly reviewing and adjusting your investment strategy can help you stay on track to achieve your financial goals.

Managing Risks When You Invest Money Online

Investing always involves some level of risk, and managing these risks is crucial when you invest money online. One way to manage risk is through diversification, as discussed earlier. Additionally, it’s important to understand the specific risks associated with each type of investment and to choose investments that align with your risk tolerance.

Another way to manage risk is by setting stop-loss orders, which automatically sell an investment if its price falls below a certain level. This can help limit your losses in a declining market. Additionally, maintaining a diversified portfolio and regularly rebalancing it can help ensure that your investments remain aligned with your risk tolerance and financial goals.

The Role of Robo-Advisors in Online Investing

Robo-advisors have become increasingly popular as a tool to invest money online. These automated platforms use algorithms to create and manage a diversified portfolio based on your financial goals and risk tolerance. Robo-advisors typically offer lower fees compared to traditional financial advisors and can be a convenient option for beginners or those with smaller portfolios.

When you invest money online with a robo-advisor, the platform will handle tasks such as asset allocation, rebalancing, and tax optimization. Popular robo-advisors include Betterment, Wealthfront, and M1 Finance. These platforms provide a hands-off approach to investing, making it easier for you to stay on track with your investment goals.

Monitoring and Adjusting Your Online Investments

Regularly monitoring and adjusting your investments is essential when you invest money online. Keeping track of your portfolio’s performance helps you stay informed about your progress toward your financial goals. Online investment platforms typically offer tools and resources to help you monitor your investments, such as performance reports, news updates, and market analysis.

It’s also important to periodically review and adjust your investment strategy based on changes in your financial situation, goals, or market conditions. Rebalancing your portfolio ensures that it remains aligned with your risk tolerance and investment objectives. By staying proactive and making necessary adjustments, you can maximize the potential of your online investments.

Staying Informed and Educated About Online Investing

Education is a key factor in successful online investing. Continuously learning about investment principles, market trends, and new opportunities can help you make informed decisions when you invest money online. Many online investment platforms offer educational resources, including articles, webinars, and tutorials, to help you expand your knowledge.

Additionally, staying informed about current events and market developments is crucial. Subscribing to financial news sources, following investment blogs, and participating in online forums can provide valuable insights and keep you updated on the latest trends. The more educated you are, the better equipped you’ll be to navigate the complexities of online investing.

Conclusion

Investing money online offers a convenient and accessible way to build wealth and achieve your financial goals. By understanding the basics of investing, choosing the right platform, diversifying your portfolio, and employing effective strategies, you can maximize your returns and minimize risks. Managing risks, utilizing robo-advisors, and regularly monitoring and adjusting your investments are also crucial for long-term success.

Staying informed and continuously educating yourself about online investing will help you make better decisions and stay on track with your investment objectives. As you embark on your journey to invest money online, remember that patience, discipline, and a well-thought-out strategy are key to achieving your financial aspirations.

FAQs

1. What is the best way to start investing money online? The best way to start investing money online is to choose a reputable online investment platform, understand your financial goals, and start with a diversified portfolio. Begin by educating yourself about basic investment principles and consider starting with small amounts to gain experience.

2. How can I minimize risks when I invest money online? To minimize risks when you invest money online, diversify your portfolio across different asset classes, industries, and geographic regions. Additionally, set stop-loss orders, stay informed about market trends, and regularly review and rebalance your portfolio.

3. What are robo-advisors, and how do they help in online investing? Robo-advisors are automated platforms that use algorithms to create and manage a diversified investment portfolio based on your financial goals and risk tolerance. They offer lower fees compared to traditional financial advisors and provide a convenient, hands-off approach to investing.

4. How often should I review my online investment portfolio? It’s recommended to review your online investment portfolio at least quarterly. Regular reviews help you stay informed about your portfolio’s performance, make necessary adjustments, and ensure that your investments remain aligned with your financial goals and risk tolerance.

5. What are some common mistakes to avoid when investing money online? Common mistakes to avoid when investing money online include over-reliance on a single investment, failing to diversify, making emotional decisions based on market fluctuations, and not staying informed about current events and market trends. Additionally, avoid neglecting regular portfolio reviews and adjustments.