Navigating Market Structure in Forex: A Comprehensive Guide

Introduction

Forex trading, characterized by its high liquidity and 24-hour market operation, is profoundly influenced by its market structure. Understanding the market structure in Forex is crucial for traders to make informed decisions and develop effective trading strategies.

What is Market Structure in Forex?

Market structure in Forex refers to the overarching system that determines how currency prices move within the global financial markets. It encompasses various elements such as market participants, price patterns, and the overall behavior of currency pairs.

The Role of Major Market Participants

The Forex market is dominated by major players like central banks, commercial banks, and institutional investors. Each participant plays a significant role in shaping the market structure in Forex through their large-volume trades and global economic influence.

Understanding Price Movements

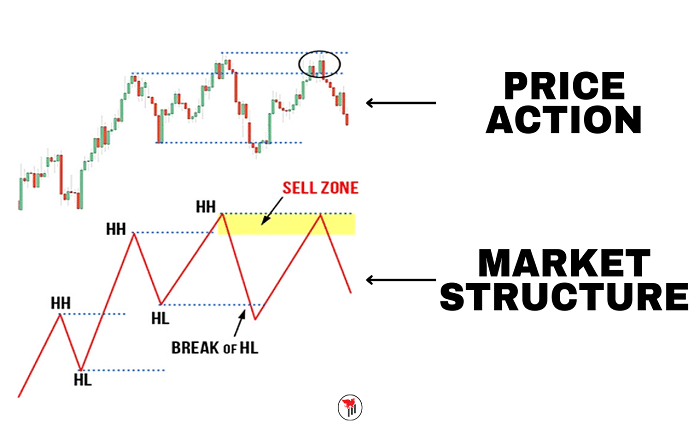

Price movements within the Forex market are a direct reflection of changes in market structure. By analyzing these movements, traders can identify potential trends and trading opportunities.

Importance of Technical Analysis

Technical analysis is an essential tool for interpreting market structure in Forex. It involves studying historical price charts and using indicators to predict future market movements based on past patterns.

Fundamental Analysis and Market Structure

While technical analysis focuses on price movements, fundamental analysis looks at economic indicators and events that influence market structure in Forex. Understanding both aspects is vital for holistic market analysis.

Trends in Forex Trading

Trends are a pivotal component of the Forex market structure. They provide insights into the general direction of currency prices and help traders in decision-making. Recognizing trends allows traders to align their strategies with the market momentum.

Impact of Global Events on Forex

Global events such as economic announcements, geopolitical tensions, and financial crises can dramatically alter the market structure in Forex. Traders need to stay informed about global events to manage risks and adjust their strategies accordingly.

Strategies for Trading Forex Market Structure

Successful trading strategies in Forex hinge on a robust understanding of market structure. Strategies may include trend following, scalping, and swing trading, each tailored to different aspects of market behavior.

Tools for Analyzing Market Structure

Several tools can help traders analyze the market structure in Forex. These include charting software, economic calendars, and trading platforms that provide real-time data and analytical capabilities.

Risk Management in Forex Trading

Effective risk management is integral to trading in the Forex market. Understanding market structure helps traders set appropriate risk levels and minimize potential losses.

Conclusion

The market structure in Forex is a dynamic and complex element that influences every aspect of trading. By understanding and leveraging this structure, traders can enhance their analytical skills, make better trading decisions, and potentially increase profitability.

FAQs

1. What is the most important aspect of market structure in Forex?

The most important aspect is understanding how different market participants affect price movements and overall market dynamics.

2. How does market structure affect individual traders?

Market structure affects trading strategies, risk management, and the potential for profit. Individual traders must adapt their strategies based on changes in the market structure.

3. Can market structure predict currency price movements?

While it doesn’t predict movements with certainty, analyzing market structure can provide valuable insights into potential price trends and turning points.

4. How important is technical analysis in understanding market structure?

Technical analysis is crucial as it helps traders visualize and interpret price movements and trends within the market structure.

5. What tools are essential for analyzing market structure in Forex?

Tools such as charting software, economic calendars, and technical indicators are essential for analyzing the market structure and making informed trading decisions.