Introduction

Stocks represent ownership in a company and a claim on a portion of its assets and earnings. Investing in stocks is a common way to build wealth and achieve financial goals. This guide will provide an in-depth understanding of stocks, covering their basics, benefits, risks, strategies, and practical tips for successful investing.

The Basics of Stocks

Stocks, also known as shares or equities, are units of ownership in a company. When you purchase a stock, you become a shareholder, which entitles you to a portion of the company’s profits and voting rights at shareholder meetings. This section will explain the fundamental concepts of stocks, including how they are issued, traded, and valued in the stock market.

Types of Stocks

There are different types of stocks, each with unique characteristics and benefits. Understanding the various types of stocks can help investors make informed decisions. This section will explore the most common types:

- Common Stocks: These stocks offer voting rights and dividends, which may vary based on the company’s performance.

- Preferred Stocks: These stocks provide fixed dividends and have priority over common stocks in asset liquidation but typically do not offer voting rights.

- Growth Stocks: Companies expected to grow at an above-average rate compared to other companies.

- Value Stocks: Stocks that are considered undervalued based on their fundamentals and offer potential for long-term growth.

- Dividend Stocks: Stocks that regularly pay dividends, providing a steady income stream.

Benefits of Investing in Stocks

Investing in stocks offers numerous benefits, making it an attractive option for building wealth. This section will discuss the key advantages of stock investing:

- Potential for High Returns: Stocks have historically provided higher returns compared to other asset classes.

- Dividend Income: Some stocks pay regular dividends, offering a source of passive income.

- Ownership in a Company: Being a shareholder provides voting rights and a sense of ownership in the company’s success.

- Liquidity: Stocks can be easily bought and sold in the market, providing flexibility to investors.

Risks of Investing in Stocks

While stocks offer significant benefits, they also come with risks. Understanding these risks is crucial for making informed investment decisions. This section will explore the primary risks associated with investing in stocks:

- Market Risk: The risk of losing money due to fluctuations in the stock market.

- Company-Specific Risk: The risk associated with a particular company’s performance and financial health.

- Volatility Risk: Stocks can experience significant price swings, leading to potential losses.

- Economic and Political Risk: Economic downturns and political events can impact stock prices.

Stock Market Basics

The stock market is a platform where stocks are bought and sold. Understanding how the stock market operates is essential for successful investing. This section will cover the basics of the stock market, including stock exchanges, market participants, and how stocks are traded.

Strategies for Investing in Stocks

Successful stock investing requires effective strategies tailored to individual financial goals and risk tolerance. This section will discuss various investment strategies, including:

- Buy and Hold: Long-term investment strategy focusing on holding stocks for an extended period.

- Value Investing: Identifying undervalued stocks with strong fundamentals for potential long-term gains.

- Growth Investing: Investing in companies with high growth potential.

- Dividend Investing: Focusing on stocks that provide regular dividend income.

- Active Trading: Buying and selling stocks frequently to capitalize on short-term price movements.

Analyzing Stocks: Fundamental and Technical Analysis

Analyzing stocks is crucial for making informed investment decisions. This section will explore two primary methods of stock analysis:

- Fundamental Analysis: Evaluating a company’s financial health, earnings, growth potential, and market position.

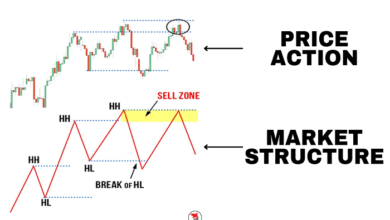

- Technical Analysis: Analyzing historical price and volume data to identify patterns and trends.

The Role of Diversification in Stock Investing

Diversification is a risk management strategy that involves spreading investments across various assets to reduce risk. This section will discuss the importance of diversification in a stock portfolio and how to implement it effectively.

Tools and Resources for Stock Investors

There are numerous tools and resources available to help investors make informed decisions. This section will highlight essential tools and resources, including financial news websites, stock screeners, trading platforms, and investment apps.

Conclusion:

Investing in stocks is a powerful way to build wealth and achieve financial goals. By understanding the basics of stocks, different types, benefits, risks, and investment strategies, investors can make informed decisions and navigate the stock market successfully. Continuous learning and staying informed about market trends are crucial for long-term success in stock investing.

FAQs

- What are stocks? Stocks, also known as shares or equities, represent ownership in a company and a claim on a portion of its assets and earnings. Investors buy stocks to participate in the company’s growth and profitability.

- What are the benefits of investing in stocks? Investing in stocks offers potential for high returns, dividend income, ownership in a company, and liquidity. Stocks have historically provided higher returns compared to other asset classes, making them an attractive option for building wealth.

- What are the risks of investing in stocks? The primary risks of investing in stocks include market risk, company-specific risk, volatility risk, and economic and political risk. Understanding these risks is crucial for making informed investment decisions and managing a stock portfolio effectively.

- What are the different types of stocks? Common types of stocks include common stocks, preferred stocks, growth stocks, value stocks, and dividend stocks. Each type has unique characteristics and benefits, suitable for different investment goals and risk tolerances.

- How can I analyze stocks for investment? Stocks can be analyzed using fundamental analysis and technical analysis. Fundamental analysis involves evaluating a company’s financial health, earnings, growth potential, and market position. Technical analysis focuses on analyzing historical price and volume data to identify patterns and trends.