Wholesale Foreign Exchange: An In-Depth Exploration

Introduction

The world of wholesale foreign exchange is vast and complex, playing a crucial role in the global economy. Wholesale foreign exchange, also known as the interbank market, involves large-scale currency transactions between financial institutions, corporations, and governments. This market is fundamental for international trade, investment, and economic stability.

What is Wholesale Foreign Exchange?

Wholesale foreign exchange refers to the trading of currencies in large volumes, typically between banks, financial institutions, and large corporations. Unlike retail forex markets where individual traders participate, the wholesale market deals with substantial amounts of money, often millions or billions of dollars in a single transaction.

The Role of Banks in Wholesale Foreign Exchange

Banks are the primary players in the wholesale foreign exchange market. They facilitate currency exchange for their clients and engage in speculative trading to profit from currency fluctuations. Major banks have dedicated forex trading desks that operate around the clock, ensuring liquidity and stability in the market.

How Wholesale Foreign Exchange Differs from Retail Forex

The wholesale foreign exchange market is distinct from retail forex in several ways. The volume of transactions is significantly higher, and the participants are mainly institutions rather than individual traders. Additionally, the wholesale market operates on a different pricing structure, with tighter spreads and better rates due to the large transaction sizes.

The Importance of Liquidity in Wholesale Foreign Exchange

Liquidity is a crucial aspect of the wholesale foreign exchange market. High liquidity ensures that large transactions can be executed quickly without significantly impacting currency prices. This is essential for maintaining market stability and allowing smooth operations for global trade and investment.

Major Currencies in Wholesale Foreign Exchange

Certain currencies dominate the wholesale foreign exchange market due to their global economic importance. These include the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Swiss Franc (CHF). These major currencies are involved in most of the world’s foreign exchange transactions.

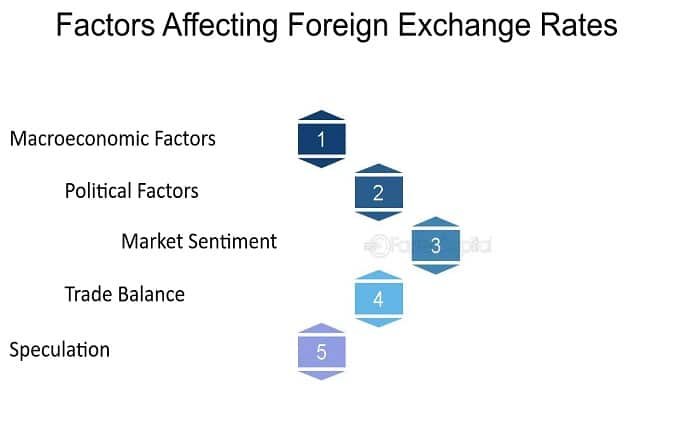

Exchange Rate Mechanisms in Wholesale Foreign Exchange

Exchange rates in the wholesale foreign exchange market are determined by supply and demand dynamics. Various factors influence these rates, including economic data, geopolitical events, and market sentiment. Central banks also play a role by setting interest rates and intervening in the market to stabilize their currencies.

Technology and Wholesale Foreign Exchange

Technology has revolutionized the wholesale foreign exchange market. Advanced trading platforms and algorithms allow for high-speed transactions and sophisticated market analysis. Electronic trading has increased market transparency and efficiency, reducing the reliance on traditional voice brokering.

Risk Management in Wholesale Foreign Exchange

Risk management is vital in the wholesale foreign exchange market due to the large volumes of money involved. Participants use various strategies, such as hedging and diversification, to mitigate risks associated with currency fluctuations. Proper risk management ensures financial stability and protects against significant losses.

The Impact of Regulations on Wholesale Foreign Exchange

Regulatory frameworks significantly impact the wholesale foreign exchange market. Governments and international bodies implement regulations to prevent fraud, ensure market transparency, and protect participants. Compliance with these regulations is crucial for maintaining the integrity and stability of the market.

Wholesale Foreign Exchange and Global Trade

Wholesale foreign exchange is indispensable for global trade. It enables businesses to convert currencies, manage exchange rate risks, and conduct cross-border transactions efficiently. Without the wholesale forex market, international trade would be far more complex and risky.

The Future of Wholesale Foreign Exchange

The future of wholesale foreign exchange looks promising with ongoing advancements in technology and increasing globalization. Innovations such as blockchain and artificial intelligence are expected to further enhance market efficiency and transparency. As global trade and investment continue to grow, the wholesale forex market will remain a cornerstone of the global economy.

Conclusion

Wholesale foreign exchange is a vital component of the global financial system. It facilitates large-scale currency transactions, supports international trade, and contributes to economic stability. Understanding the intricacies of this market is essential for financial professionals and businesses engaged in global commerce. As the world becomes more interconnected, the importance of wholesale foreign exchange will only continue to rise.

FAQs

1. What is the wholesale foreign exchange market?

The wholesale foreign exchange market is where large-scale currency transactions occur between banks, financial institutions, and corporations, unlike the retail forex market which involves individual traders.

2. How do banks participate in wholesale foreign exchange?

Banks facilitate currency exchange for their clients, engage in speculative trading, and operate forex trading desks that provide liquidity and stability in the market.

3. What are the major currencies in the wholesale foreign exchange market?

The major currencies include the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Swiss Franc (CHF), which are involved in most global foreign exchange transactions.

4. How does technology impact the wholesale foreign exchange market?

Technology has introduced advanced trading platforms and algorithms that enable high-speed transactions, sophisticated market analysis, and increased market transparency and efficiency.

5. Why is liquidity important in the wholesale foreign exchange market?

High liquidity ensures that large transactions can be executed quickly without significantly impacting currency prices, maintaining market stability and facilitating smooth global trade and investment.